Monetary Policy and the Labor Market: A Quasi-Experiment in Sweden

Abstract

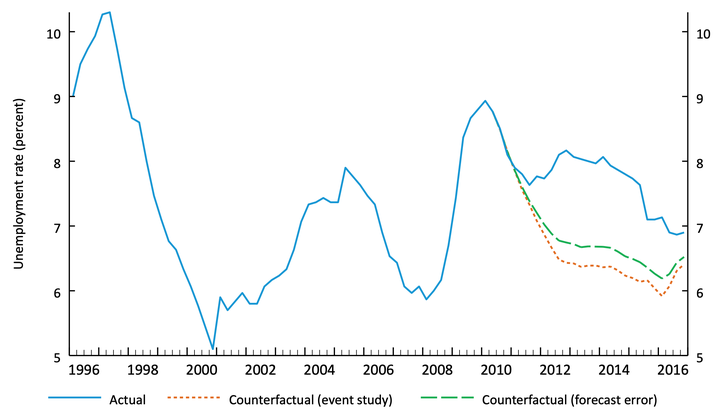

We analyze a monetary quasi-experiment in Sweden from 2010–2011, when the Riksbank raised the interest rate substantially. We argue that this increase was beyond what labor market conditions warranted, driven instead by new concerns about financial stability. Using a battery of specifications that rule out domestic or international confounders, we show that this monetary tightening led to a substantial economic contraction, raising unemployment by 1–2 percentage points. Using administrative microdata, we find that sectors with nominal wage rigidity drove much of the response and that the monetary contraction was more regressive than the typical business cycle.

Type